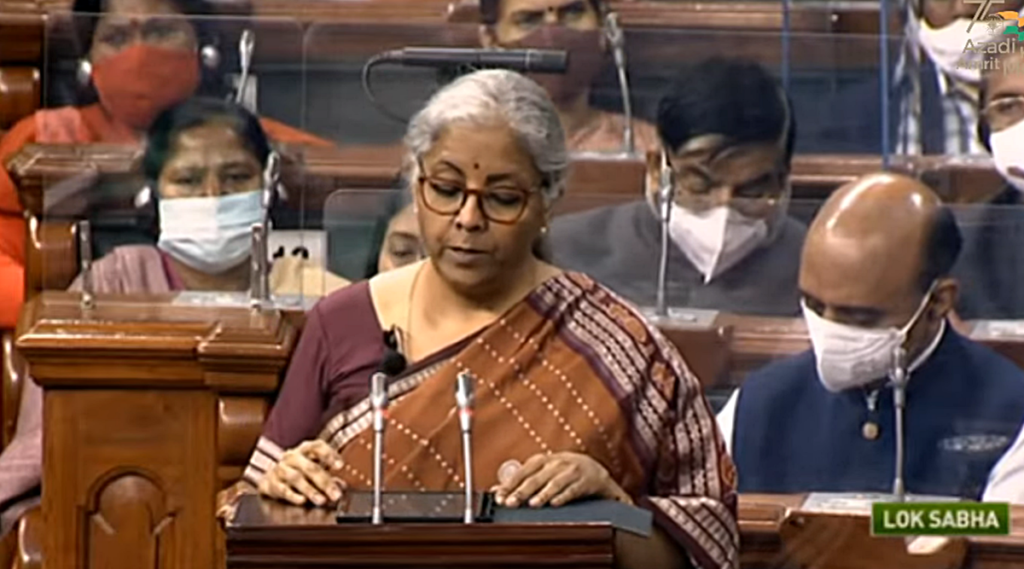

Finance Minister Nirmala Sitharaman Budget 2022-23 focusses on Infrastructure & big push for AatamNirbhar Bharat

Finance Minister Nirmala Sitharaman presented the Union budget 2022 on Tuesday. Highlighting that there was a sharp increase in public investment and capital expenditure in the last budget, the Finance Minister added that Budget 2022-23 will benefit, youth, women, farmers, and SC & ST.

Here is the full text of Sitharaman’s Budget 2022 speech:

Hon’ble Speaker,

I present the Budget for the year 2022-23.

- At the outset, I want to take a moment to express my empathy for those who had to bear adverse health and economic effects of the pandemic.

- The overall, sharp rebound and recovery of the economy is reflective of our country’s strong resilience. India’s economic growth in the current year is estimated to be 9.2 per cent, highest among all large economies.

- I recognise we are in the midst of an Omicron wave, with high incidence, but milder symptoms. Further, the speed and coverage of our vaccination campaign has helped greatly. With the accelerated improvement of health infrastructure in the past two years, we are in a strong position to withstand challenges. I am confident that with Sabka Prayas we will continue our journey of strong growth.

- Hon’ble Speaker, we are marking Azadi ka Amrit Mahotsav, and have entered into Amrit Kaal, the 25-year-long leadup to India@100. Hon’ble Prime Minister in his Independence Day address had set-out the vision for India@100.

- By achieving certain goals during the Amrit Kaal, our government aims to attain the vision. They are:

* Complementing the macro-economic level growth focus with a micro-economic level all-inclusive welfare focus,

* Promoting digital economy & fintech, technology enabled development, energy transition, and climate action, and

* Relying on virtuous cycle starting from private investment with public capital investment helping to crowd-in private investment.

- Since 2014 our government’s focus has been on empowerment of citizens, especially the poor and the marginalised. Measures have included programmes that have provided housing, electricity, cooking gas, and access to water. We also have programmes for ensuring financial inclusion and direct benefit transfers. We are committed to strengthening the abilities of the poor to tap all opportunities. Our government constantly strives to provide the necessary ecosystem for the middle classes – a vast and wide section which is populated across various middle-income brackets – to make use of the opportunities they so desire.

- This Budget seeks to lay the foundation and give a blueprint to steer the economy over the Amrit Kaal of the next 25 years – from India at 75 to India at 100. It continues to build on the vision drawn in the Budget of 2021-22. Its fundamental tenets, which included transparency of financial statement and fiscal position, reflect the government’s intent, strengths, and challenges. This continues to guide us.

- The initiatives of the last year’s Budget have seen significant progress and have been provided with adequate allocations in this Budget as well.

- The strengthening of health infrastructure, speedy implementation of the vaccination programme, and the nation-wide resilient response to the current wave of the pandemic, are evident for all.

- The Productivity Linked Incentive in 14 sectors for achieving the vision of AtmaNirbhar Bharat has received excellent response, with potential to create 60 lakh new jobs, and an additional production of ` 30 lakh crore during next 5 years.

- Towards implementation of the new Public Sector Enterprise policy, the strategic transfer of ownership of Air India has been completed. The strategic partner for NINL (Neelanchal Ispat Nigam Limited) has been selected. The public issue of the LIC is expected shortly. Others too are in the process for 2022-23.

- The National Bank for Financing Infrastructure and Development (NaBFID) and National Asset Reconstruction Company have commenced their activities.

- Hon’ble Speaker sir, Budget 2021-22 had provided a sharp increase in provision for public investment or capital expenditure. Throughout the year, with the Hon’ble Prime Minister, guiding the implementation, our economic recovery is continuing to benefit from the multiplier effect.

- This Budget continues to provide impetus for growth. It lays a parallel track of (1) a blueprint for the Amrit Kaal, which is futuristic and inclusive. This will directly benefit our youth, women, farmers, the Scheduled Castes and the Scheduled Tribes. And (2) big public investment for modern infrastructure, readying for India at 100. This shall be guided by PM GatiShakti and be benefited by the synergy of multi-modal approach. Moving forward, on this parallel track, we lay the following four priorities:

* PM GatiShakti

* Inclusive Development

* Productivity Enhancement & Investment, Sunrise Opportunities, Energy Transition, and Climate Action

* Financing of Investments

PM GatiShakti

- PM GatiShakti is a transformative approach for economic growth and sustainable development. The approach is driven by seven engines, namely, Roads, Railways, Airports, Ports, Mass Transport, Waterways, and Logistics Infrastructure. All seven engines will pull forward the economy in unison. These engines are supported by the complementary roles of Energy Transmission, IT Communication, Bulk Water & Sewerage, and Social Infrastructure. Finally, the approach is powered by Clean Energy and Sabka Prayas – the efforts of the Central Government, the state governments, and the private sector together – leading to huge job and entrepreneurial opportunities for all, especially the youth.

PM GatiShakti National Master Plan

- The scope of PM GatiShakti National Master Plan will encompass the seven engines for economic transformation, seamless multimodal connectivity and logistics efficiency. It will also include the infrastructure developed by the state governments as per the GatiShakti Master Plan. The 4 focus will be on planning, financing including through innovative ways, use of technology, and speedier implementation.

- The projects pertaining to these 7 engines in the National Infrastructure Pipeline will be aligned with PM GatiShakti framework. The touchstone of the Master Plan will be world-class modern infrastructure and logistics synergy among different modes of movement – both of people and goods – and location of projects. This will help raise productivity, and accelerate economic growth and development.

Road Transport

- PM GatiShakti Master Plan for Expressways will be formulated in 2022-23 to facilitate faster movement of people and goods. The National Highways network will be expanded by 25,000 km in 2022-23. ` 20,000 crore will be mobilized through innovative ways of financing to complement the public resources.

Seamless Multimodal Movement of Goods and People

- The data exchange among all mode operators will be brought on Unified Logistics Interface Platform (ULIP), designed for Application Programming Interface (API). This will provide for efficient movement of goods through different modes, reducing logistics cost and time, assisting just-in-time inventory management, and in eliminating tedious documentation. Most importantly, this will provide real time information to all stakeholders, and improve international competitiveness. Open-source mobility stack, for organizing seamless travel of passengers will also be facilitated.

Multimodal Logistics Parks

- Contracts for implementation of Multimodal Logistics Parks at four locations through PPP mode will be awarded in 2022-23.

Railways

- Railways will develop new products and efficient logistics services for small farmers and Small and Medium Enterprises, besides taking the lead in integration of Postal and Railways networks to provide seamless solutions for movement of parcels.

- ‘One Station-One Product’ concept will be popularized to help local businesses & supply chains.

- As a part of Atmanirbhar Bharat, 2,000 km of network will be brought under Kavach, the indigenous world-class technology for safety and capacity augmentation in 2022-23. Four hundred new-generation Vande Bharat Trains with better energy efficiency and passenger riding experience will be developed and manufactured during the next three years.

- One hundred PM GatiShakti Cargo Terminals for multimodal logistics facilities will be developed during the next three years.

Mass Urban Transport including Connectivity to Railways

- Innovative ways of financing and faster implementation will be encouraged for building metro systems of appropriate type at scale. Multimodal connectivity between mass urban transport and railway stations will be facilitated on priority. Design of metro systems, including civil structures, will be re-oriented and standardized for Indian conditions and needs.

Parvatmala: National Ropeways Development Programme

- As a preferred ecologically sustainable alternative to conventional roads in difficult hilly areas, National Ropeways Development Programme will be taken up on PPP mode. The aim is to improve connectivity and convenience for commuters, besides promoting tourism. This may also cover congested urban areas, where conventional mass transit system is not feasible. Contracts for 8 ropeway projects for a length of 60 km will be awarded in 2022-23.

Capacity Building for Infrastructure Projects

- With technical support from the Capacity Building Commission, central ministries, state governments, and their infra-agencies will have their skills upgraded. This will ramp up capacity in planning, design, financing (including innovative ways), and implementation management of the PM GatiShakti infrastructure projects.

Inclusive Development

Agriculture

- The procurement of wheat in Rabi 2021-22 and the estimated procurement of paddy in Kharif 2021-22 will cover 1208 lakh metric tonnes of wheat and paddy from 163 lakh farmers, and ` 2.37 lakh crore direct payment of MSP value to their accounts.

- Chemical-free Natural Farming will be promoted throughout the country, with a focus on farmers’ lands in 5-km wide corridors along river Ganga, at the first stage.

- 2023 has been announced as the International Year of Millets. Support will be provided for post-harvest value addition, enhancing domestic consumption, and for branding millet products nationally and internationally.

- To reduce our dependence on import of oilseeds, a rationalised and comprehensive scheme to increase domestic production of oilseeds will be implemented.

- For delivery of digital and hi-tech services to farmers with involvement of public sector research and extension institutions along with private agri-tech players and stakeholders of agri-value chain, a scheme in PPP mode will be launched.

- Use of ‘Kisan Drones’ will be promoted for crop assessment, digitization of land records, spraying of insecticides, and nutrients.

- States will be encouraged to revise syllabi of agricultural universities to meet the needs of natural, zero-budget and organic farming, modern-day agriculture, value addition and management.

- A fund with blended capital, raised under the co-investment model, will be facilitated through NABARD. This is to finance startups for agriculture & rural enterprise, relevant for farm produce value chain. The activities for these startups will include, inter alia, support for FPOs, machinery for farmers on rental basis at farm level, and technology including IT-based support.

Ken Betwa project and Other River Linking Projects

- Implementation of the Ken-Betwa Link Project, at an estimated cost of ` 44,605 crore will be taken up. This is aimed at providing irrigation benefits to 9.08 lakh hectare of farmers’ lands, drinking water supply for 62 lakh people, 103 MW of Hydro, and 27 MW of solar power. Allocations of ` 4,300 crore in RE 2021-22 and ` 1,400 crore in 2022-23 have been made for this project.

- Draft DPRs of five river links, namely Damanganga-Pinjal, Par-TapiNarmada, Godavari-Krishna, Krishna-Pennar and Pennar-Cauvery have been 7 finalized. Once a consensus is reached among the beneficiary states, the Centre will provide support for implementation.

Food Processing

- For farmers to adopt suitable varieties of fruits and vegetables, and to use appropriate production and harvesting techniques, our government will provide a comprehensive package with participation of state governments. MSME

- Udyam, e-Shram, NCS and ASEEM portals will be interlinked. Their scope will be widened. They will now perform as portals with live, organic databases, providing G2C, B2C and B2B services. These services will relate to credit facilitation, skilling, and recruitment with an aim to further formalise the economy and enhance entrepreneurial opportunities for all.

- Emergency Credit Line Guarantee Scheme (ECLGS) has provided much-needed additional credit to more than 130 lakh MSMEs. This has helped them mitigate the adverse impact of the pandemic. The hospitality and related services, especially those by micro and small enterprises, are yet to regain their pre-pandemic level of business. Considering these aspects, the ECLGS will be extended up to March 2023 and its guarantee cover will be expanded by ` 50,000 crore to total cover of ` 5 lakh crore, with the additional amount being earmarked exclusively for the hospitality and related enterprises.

- Credit Guarantee Trust for Micro and Small Enterprises (CGTMSE) scheme will be revamped with required infusion of funds. This will facilitate additional credit of ` 2 lakh crore for Micro and Small Enterprises and expand employment opportunities.

- Raising and Accelerating MSME Performance (RAMP) programme with outlay of ` 6,000 crore over 5 years will be rolled out. This will help the MSME sector become more resilient, competitive and efficient.

Skill Development

- Skilling programmes and partnership with the industry will be reoriented to promote continuous skilling avenues, sustainability, and employability. The National Skill Qualification Framework (NSQF) will be aligned with dynamic industry needs. 8

- Digital Ecosystem for Skilling and Livelihood – the DESH-Stack eportal – will be launched. This aims to empower citizens to skill, reskill or upskill through on-line training. It will also provide API-based trusted skill credentials, payment and discovery layers to find relevant jobs and entrepreneurial opportunities.

- Startups will be promoted to facilitate ‘Drone Shakti’ through varied applications and for Drone-As-A-Service (DrAAS). In select ITIs, in all states, the required courses for skilling, will be started.

Universalization of Quality Education

- Due to the pandemic-induced closure of schools, our children, particularly in the rural areas, and those from Scheduled Castes and Scheduled Tribes, and other weaker sections, have lost almost 2 years of formal education. Mostly, these are children in government schools. We recognise the need to impart supplementary teaching and to build a resilient mechanism for education delivery. For this purpose, ‘one class-one TV channel’ programme of PM eVIDYA will be expanded from 12 to 200 TV channels. This will enable all states to provide supplementary education in regional languages for classes 1-12.

- In vocational courses, to promote crucial critical thinking skills, to give space for creativity, 750 virtual labs in science and mathematics, and 75 skilling e-labs for simulated learning environment, will be set-up in 2022-23.

- High-quality e-content in all spoken languages will be developed for delivery via internet, mobile phones, TV and radio through Digital Teachers.

- A competitive mechanism for development of quality e-content by the teachers will be set-up to empower and equip them with digital tools of teaching and facilitate better learning outcomes.

Digital University

- A Digital University will be established to provide access to students across the country for world-class quality universal education with personalised learning experience at their doorsteps. This will be made available in different Indian languages and ICT formats. The University will be built on a networked hub-spoke model, with the hub building cutting edge ICT expertise. The best public universities and institutions in the country will collaborate as a network of hub-spokes. 9

Ayushman Bharat Digital Mission

- An open platform, for the National Digital Health Ecosystem will be rolled out. It will consist of digital registries of health providers and health facilities, unique health identity, consent framework, and universal access to health facilities.

National Tele Mental Health Programme

- The pandemic has accentuated mental health problems in people of all ages. To better the access to quality mental health counselling and care services, a ‘National Tele Mental Health Programme’ will be launched. This will include a network of 23 tele-mental health centres of excellence, with NIMHANS being the nodal centre and International Institute of Information Technology-Bangalore (IIITB) providing technology support.

Mission Shakti, Mission Vatsalya, Saksham Anganwadi & Poshan 2.0

- Recognizing the importance of Nari Shakti as the harbinger of our bright future and for women-led development during the Amrit Kaal, our government has comprehensively revamped the schemes of the Ministry of Women & Child Development. Accordingly, three schemes, namely, Mission Shakti, Mission Vatsalya, Saksham Anganwadi and Poshan 2.0 were launched recently to provide integrated benefits to women and children. Saksham Anganwadis are a new generation anganwadis that have better infrastructure and audio-visual aids, powered by clean energy and providing improved environment for early child development. Two lakh anganwadis will be upgraded under the Scheme.

Har Ghar, Nal Se Jal

- Current coverage of Har Ghar, Nal Se Jal is 8.7 crores. Of this 5.5 crore households were provided tap water in last 2 years itself. Allocation of ` 60,000 crore has been made with an aim to cover 3.8 crore households in 2022-23.

Housing for All

- In 2022-23 80 lakh houses will be completed for the identified eligible beneficiaries of PM Awas Yojana, both rural and urban. ` 48,000 crore is allocated for this purpose.

- The Central Government will work with the state governments for reduction of time required for all land and construction related approvals, for promoting affordable housing for middle class and Economically Weaker 10 Sections in urban areas. We shall also work with the financial sector regulators to expand access to capital along with reduction in cost of intermediation.

Prime Minister’s Development Initiative for North East Region (PMDevINE)

- A new scheme, Prime Minister’s Development Initiative for NorthEast, PM-DevINE, will be implemented through the North-Eastern Council. It will fund infrastructure, in the spirit of PM GatiShakti, and social development projects based on felt needs of the North-East. This will enable livelihood activities for youth and women, filling the gaps in various sectors. It will not be a substitute for existing central or state schemes. While the central ministries may also pose their candidate projects, priority will be given to those posed by the states. An initial allocation of ` 1,500 crore will be made, and the initial list of projects is given in Annexure-1.

Aspirational Blocks Programme

- Our vision to improve the quality of life of citizens in the most backward districts of the country through Aspirational Districts Programme has been translated into reality in a short span of time. 95 per cent of those 112 districts have made significant progress in key sectors such as health, nutrition, financial inclusion and basic infrastructure. They have surpassed the state average values. However, in those districts, some blocks continue to lag. In 2022-23, the programme will focus on such blocks in those districts.

Vibrant Villages Programme

- Border villages with sparse population, limited connectivity and infrastructure often get left out from the development gains. Such villages on the northern border will be covered under the new Vibrant Villages Programme. The activities will include construction of village infrastructure, housing, tourist centres, road connectivity, provisioning of decentralized renewable energy, direct to home access for Doordarshan and educational channels, and support for livelihood generation. Additional funding for these activities will be provided. Existing schemes will be converged. We will define their outcomes and monitor them on a constant basis.

Anytime – Anywhere Post Office Savings

- In 2022, 100 per cent of 1.5 lakh post offices will come on the core banking system enabling financial inclusion and access to accounts through 11 net banking, mobile banking, ATMs, and also provide online transfer of funds between post office accounts and bank accounts. This will be helpful, especially for farmers and senior citizens in rural areas, enabling interoperability and financial inclusion.

Digital Banking

- In recent years, digital banking, digital payments and fintech innovations have grown at a rapid pace in the country. Government is continuously encouraging these sectors to ensure that the benefits of digital banking reach every nook and corner of the country in a consumer-friendly manner. Taking forward this agenda, and to mark 75 years of our independence, it is proposed to set up 75 Digital Banking Units (DBUs) in 75 districts of the country by Scheduled Commercial Banks.

Digital Payments

- The financial support for digital payment ecosystem announced in the previous Budget will continue in 2022-23. This will encourage further adoption of digital payments. There will also be a focus to promote use of payment platforms that are economical and user friendly.

Productivity Enhancement & Investment, Sunrise Opportunities, Energy

Transition, and Climate Action

Productivity Enhancement & Investment Ease of Doing Business 2.0 & Ease of Living

- In recent years, over 25,000 compliances were reduced and 1486 Union laws were repealed. This is the result of our government’s strong commitment for ‘minimum government & maximum governance’, our trust in the public, and ease of doing business (EODB).

- For the Amrit Kaal, the next phase of Ease of Doing Business EODB 2.0 and Ease of Living, will be launched. In our endeavour to improve productive efficiency of capital and human resources, we will follow the idea of ‘trust-based governance’.

- This new phase will be guided by an active involvement of the states, digitisation of manual processes and interventions, integration of the central and state-level systems through IT bridges, a single point access for all citizen-centric services, and a standardization and removal of overlapping compliances. Crowdsourcing of suggestions and ground level 12 assessment of the impact with active involvement of citizens and businesses will be encouraged. Green Clearances

- A single window portal, PARIVESH, for all green clearances was launched in 2018. It has been instrumental in reducing the time required for approvals significantly. The scope of this portal will now be expanded, to provide information to the applicants. Based on location of units, information about specific approvals will be provided. It will enable application for all four approvals through a single form, and tracking of the process through Centralized Processing Centre-Green (CPC-Green). e-Passport

- The issuance of e-Passports using embedded chip and futuristic technology will be rolled out in 2022-23 to enhance convenience for the citizens in their overseas travel.

Urban Development

- By the time of India @ 100, nearly half our population is likely to be living in urban areas. To prepare for this, orderly urban development is of critical importance. This will help realize the country’s economic potential, including livelihood opportunities for the demographic dividend. For this, on the one hand we need to nurture the megacities and their hinterlands to become current centres of economic growth. On the other hand, we need to facilitate tier 2 and 3 cities to take on the mantle in the future. This would require us to reimagine our cities into centres of sustainable living with opportunities for all, including women and youth. For this to happen, urban planning cannot continue with a business-as-usual approach. We plan to steer a paradigm change.

- A high-level committee of reputed urban planners, urban economists and institutions will be formed to make recommendations on urban sector policies, capacity building, planning, implementation and governance.

Urban Planning Support to States

- For urban capacity building, support will be provided to the states. Modernization of building byelaws, Town Planning Schemes (TPS), and Transit Oriented Development (TOD) will be implemented. This will facilitate reforms for people to live and work closer to mass transit systems. 13 The Central Government’s financial support for mass transit projects and AMRUT scheme will be leveraged for formulation of action plans and their implementation for facilitating TOD and TPS by the states.

- For developing India specific knowledge in urban planning and design, and to deliver certified training in these areas, up to five existing academic institutions in different regions will be designated as centres of excellence. These centres will be provided endowment funds of ` 250 crore each. In addition, AICTE will take the lead to improve syllabi, quality and access of urban planning courses in other institutions.

Clean & Sustainable Mobility

- We will promote a shift to use of public transport in urban areas. This will be complemented by clean tech and governance solutions, special mobility zones with zero fossil-fuel policy, and EV vehicles.

Battery Swapping Policy

- Considering the constraint of space in urban areas for setting up charging stations at scale, a battery swapping policy will be brought out and inter-operability standards will be formulated. The private sector will be encouraged to develop sustainable and innovative business models for ‘Battery or Energy as a Service’. This will improve efficiency in the EV ecosystem.

Land Records Management

- Efficient use of land resources is a strong imperative. States will be encouraged to adopt Unique Land Parcel Identification Number to facilitate IT-based management of records. The facility for transliteration of land records across any of the Schedule VIII languages will also be rolled out.

- The adoption or linkage with National Generic Document Registration System (NGDRS) with the ‘One-Nation One-Registration Software’ will be promoted as an option for uniform process for registration and ‘anywhere registration’ of deeds & documents.

Insolvency and Bankruptcy Code

- Necessary amendments in the Code will be carried out to enhance the efficacy of the resolution process and facilitate cross border insolvency resolution.

Accelerated Corporate Exit

- Several IT-based systems have been established for accelerated registration of new companies. Now the Centre for Processing Accelerated Corporate Exit (C-PACE) with process re-engineering, will be established to facilitate and speed up the voluntary winding-up of these companies from the currently required 2 years to less than 6 months.

Government Procurement

- Government rules have recently been modernized for the needs the Amrit Kaal. The new rules have benefitted from the inputs from various stakeholders. The modernised rules allow use of transparent quality criteria besides cost in evaluation of complex tenders. Provisions have been made for payment of 75 per cent of running bills, mandatorily within 10 days and for encouraging settlement of disputes through conciliation.

- As a further step to enhance transparency and to reduce delays in payments, a completely paperless, end-to-end online e-Bill System will be launched for use by all central ministries for their procurements. The system will enable the suppliers and contractors to submit online their digitally signed bills and claims and track their status from anywhere.

- To reduce indirect cost for suppliers and work-contractors, the use of surety bonds as a substitute for bank guarantee will be made acceptable in government procurements. Business such as gold imports may also find this useful. IRDAI has given the framework for issue of surety bonds by insurance companies. AVGC Promotion Task Force

- The animation, visual effects, gaming, and comic (AVGC) sector offers immense potential to employ youth. An AVGC promotion task force with all stakeholders will be set-up to recommend ways to realize this and build domestic capacity for serving our markets and the global demand.

Telecom Sector

- Telecommunication in general, and 5G technology in particular, can enable growth and offer job opportunities. Required spectrum auctions will be conducted in 2022 to facilitate rollout of 5G mobile services within 2022-23 by private telecom providers.

- A scheme for design-led manufacturing will be launched to build a strong ecosystem for 5G as part of the Production Linked Incentive Scheme.

- To enable affordable broadband and mobile service proliferation in rural and remote areas, five per cent of annual collections under the Universal Service Obligation Fund will be allocated. This will promote R&D and commercialization of technologies and solutions.

- Our vision is that all villages and their residents should have the same access to e-services, communication facilities, and digital resources as urban areas and their residents. The contracts for laying optical fibre in all villages, including remote areas, will be awarded under the Bharatnet project through PPP in 2022-23. Completion is expected in 2025. Measures will be taken to enable better and more efficient use of the optical fibre.

Export Promotion

- The Special Economic Zones Act will be replaced with a new legislation that will enable the states to become partners in ‘Development of Enterprise and Service Hubs’. This will cover all large existing and new industrial enclaves to optimally utilise available infrastructure and enhance competitiveness of exports.

AtmaNirbharta in Defence

- Our Government is committed to reducing imports and promoting AtmaNirbharta in equipment for the Armed Forces. 68 per cent of the capital procurement budget will be earmarked for domestic industry in 2022-23, up from 58 per cent in 2021-22.

- Defence R&D will be opened up for industry, startups and academia with 25 per cent of defence R&D budget earmarked. Private industry will be encouraged to take up design and development of military platforms and equipment in collaboration with DRDO and other organizations through SPV model. An independent nodal umbrella body will be set up for meeting wide ranging testing and certification requirements.

Sunrise Opportunities

- Artificial Intelligence, Geospatial Systems and Drones, Semiconductor and its eco-system, Space Economy, Genomics and Pharmaceuticals, Green Energy, and Clean Mobility Systems have immense potential to assist sustainable development at scale and modernize the country. They provide employment opportunities for youth, and make Indian industry more efficient and competitive.

- Supportive policies, light-touch regulations, facilitative actions to build domestic capacities, and promotion of research & development will guide the government’s approach. For R&D in these sunrise opportunities, in addition to efforts of collaboration among academia, industry and public institutions, government contribution will be provided.

Energy Transition and Climate Action

- The risks of climate change are the strongest negative externalities that affect India and other countries. As Hon’ble Prime Minister said at the COP26 summit in Glasgow last November, “what is needed today is mindful and deliberate utilisation, instead of mindless and destructive consumption.” The low carbon development strategy as enunciated in the ‘panchamrit’ that he announced is an important reflection of our government’s strong commitment towards sustainable development.

- This strategy opens up huge employment opportunities and will take the country on a sustainable development path. This budget proposes several near-term and long-term actions accordingly. Solar Power

- To facilitate domestic manufacturing for the ambitious goal of 280 GW of installed solar capacity by 2030, an additional allocation of ` 19,500 crore for Production Linked Incentive for manufacture of high efficiency modules, with priority to fully integrated manufacturing units from polysilicon to solar PV modules, will be made.

Circular Economy

- The Circular Economy transition is expected to help in productivity enhancement as well as creating large opportunities for new businesses and jobs. The action plans for ten sectors such as electronic waste, end-of-life vehicles, used oil waste, and toxic & hazardous industrial waste are ready. The focus now will be on addressing important cross cutting issues of infrastructure, reverse logistics, technology upgradation and integration with informal sector. This will be supported by active public policies covering regulations, extended producers’ responsibilities framework and innovation facilitation.

Transition to Carbon Neutral Economy

- Five to seven per cent biomass pellets will be co-fired in thermal power plants resulting in CO2 savings of 38 MMT annually. This will also provide extra income to farmers and job opportunities to locals and help avoid stubble burning in agriculture fields.

- Saving energy is an important aspect of energy management. Hence, energy efficiency and savings measures will be promoted. This will be done in large commercial buildings through the Energy Service Company (ESCO) business model. It will facilitate capacity building and awareness for energy audits, performance contracts, and common measurement & verification protocol.

- Four pilot projects for coal gasification and conversion of coal into chemicals required for the industry will be set-up to evolve technical and financial viability.

- The policies and required legislative changes to promote agro forestry and private forestry will be brought in. In addition, financial support will be provided to farmers belonging to Scheduled Castes and Scheduled Tribes, who want to take up agro-forestry.

Financing of Investments

Public Capital Investment

- Capital investment holds the key to speedy and sustained economic revival and consolidation through its multiplier effect. Capital investment also helps in creating employment opportunities, inducing enhanced demand for manufactured inputs from large industries and MSMEs, services from professionals, and help farmers through better agri-infrastructure. The economy has shown strong resilience to come out of the effects of the pandemic with high growth. However, we need to sustain that level to make up for the setback of 2020-21.

- As outlined in para 5 earlier, the virtuous cycle of investment requires public investment to crowd-in private investment. At this stage, private investments seem to require that support to rise to their potential and to the needs of the economy. Public investment must continue to take the lead and pump-prime the private investment and demand in 2022-23.

- Considering the above imperative, the outlay for capital expenditure in the Union Budget is once again being stepped up sharply by 35.4 per cent from ` 5.54 lakh crore in the current year to ` 7.50 lakh crore in 2022-23. This has increased to more than 2.2 times the expenditure of 2019-20. This outlay in 2022-23 will be 2.9 per cent of GDP.

Effective Capital Expenditure

- With this investment taken together with the provision made for creation of capital assets through Grants-in-Aid to States, the ‘Effective Capital Expenditure’ of the Central Government is estimated at ` 10.68 lakh crore in 2022-23, which will be about 4.1 per cent of GDP. Green Bonds

- As a part of the government’s overall market borrowings in 2022-23, sovereign Green Bonds will be issued for mobilizing resources for green infrastructure. The proceeds will be deployed in public sector projects which help in reducing the carbon intensity of the economy.

GIFT-IFSC

- World-class foreign universities and institutions will be allowed in the GIFT City to offer courses in Financial Management, FinTech, Science, Technology, Engineering and Mathematics free from domestic regulations, except those by IFSCA to facilitate availability of high-end human resources for financial services and technology.

- An International Arbitration Centre will be set up in the GIFT City for timely settlement of disputes under international jurisprudence.

- Services for global capital for sustainable & climate finance in the country will be facilitated in the GIFT City.

Infrastructure Status

- Data Centres and Energy Storage Systems including dense charging infrastructure and grid-scale battery systems will be included in the harmonized list of infrastructure. This will facilitate credit availability for digital infrastructure and clean energy storage.

Venture Capital and Private Equity Investment

- Venture Capital and Private Equity invested more than ` 5.5 lakh crore last year facilitating one of the largest start-up and growth ecosystem. Scaling up this investment requires a holistic examination of regulatory and other frictions. An expert committee will be set up to examine and suggest appropriate measures.

Blended Finance

- Government backed Funds NIIF and SIDBI Fund of Funds have provided scale capital creating a multiplier effect. For encouraging important sunrise sectors such as Climate Action, Deep-Tech, Digital Economy, Pharma and Agri-Tech, the government will promote thematic funds for blended finance with the government share being limited to 20 per cent and the funds being managed by private fund managers.

Financial Viability of Infrastructure Projects

- For financing the infrastructure needs, the stepping-up of public investment will need to be complemented by private capital at a significant scale. Measures will be taken to enhance financial viability of projects including PPP, with technical and knowledge assistance from multi-lateral agencies. Enhancing financial viability shall also be obtained by adopting global best practices, innovative ways of financing, and balanced risk allocation.

Digital Rupee

- Introduction of Central Bank Digital Currency (CBDC) will give a big boost to digital economy. Digital currency will also lead to a more efficient and cheaper currency management system. It is, therefore, proposed to introduce Digital Rupee, using blockchain and other technologies, to be issued by the Reserve Bank of India starting 2022-23.

Financial Assistance to States for Capital Investment

- Reflecting the true spirit of cooperative federalism, the Central Government is committed to bolstering the hands of the states in enhancing their capital investment towards creating productive assets and generating remunerative employment. The ‘Scheme for Financial Assistance to States for Capital Investment’ has been extremely well received by the states. In deference to the requests received during my meeting with Chief Ministers and state Finance Ministers, the outlay for this scheme is being enhanced from ` 10,000 crore in the Budget Estimates to ` 15,000 crore in the Revised Estimates for the current year.

- For 2022-23, the allocation is ` 1 lakh crore to assist the states in catalysing overall investments in the economy. These fifty-year interest free loans are over and above the normal borrowings allowed to the states.

- This allocation will be used for PM GatiShakti related and other productive capital investment of the states. It will also include components for: * Supplemental funding for priority segments of PM Gram Sadak Yojana, including support for the states’ share,

* Digitisation of the economy, including digital payments and completion of OFC network, and

* Reforms related to building byelaws, town planning schemes, transit-oriented development, and transferable development rights.

- In 2022-23, in accordance with the recommendations of the 15th Finance Commission, the states will be allowed a fiscal deficit of 4 per cent of GSDP of which 0.5 per cent will be tied to power sector reforms, for which the conditions have already been communicated in 2021-22.

Fiscal Management

- As against a total expenditure of ` 34.83 lakh crore projected in the Budget Estimates 2021-22, the Revised Estimate is ` 37.70 lakh crore. The Revised Estimate of capital expenditure is ` 6.03 lakh crore. This includes an amount of ` 51,971 crore towards settlement of outstanding guaranteed liabilities of Air India and its other sundry commitments.

- Coming to the Budget Estimates, the total expenditure in 2022-23 is estimated at ` 39.45 lakh crore, while the total receipts other than borrowings are estimated at ` 22.84 lakh crore.

- The revised Fiscal Deficit in the current year is estimated at 6.9 per cent of GDP as against 6.8 per cent projected in the Budget Estimates. The Fiscal Deficit in 2022-23 is estimated at 6.4 per cent of GDP, which is consistent with the broad path of fiscal consolidation announced by me last year to reach a fiscal deficit level below 4.5 per cent by 2025-26. While setting the fiscal deficit level in 2022-23, I am conscious of the need to nurture growth, through public investment, to become stronger and sustainable.

I will, now, move to Part B of my speech.

PART B

Direct Tax

- Hon’ble Speaker, Sir, I take this opportunity to thank all the taxpayers of our country who have contributed immensely and strengthened the hands of the government in helping their fellow citizens in this hour of need.

“The king must make arrangements for Yogakshema (welfare) of the populace by way of abandoning any laxity and by governing the state in line with Dharma, along with collecting taxes which are in consonance with the Dharma.” Mahabharat, Shanti ParvaAdhyaya. 72. Shlok 11.

- Drawing wisdom from our ancient texts, we continue on the path to progress. The proposals in this budget, while continuing with our declared policy of stable and predictable tax regime, intend to bring more reforms that will take ahead our vision to establish a trustworthy tax regime. This will further simplify the tax system, promote voluntary compliance by taxpayers, and reduce litigation.

Introducing new ‘Updated return’

- India is growing at an accelerated pace and people are undertaking multiple financial transactions. The Income Tax Department has established a robust framework of reporting of taxpayers’ transactions. In this context, some taxpayers may realize that they have committed omissions or mistakes in correctly estimating their income for tax payment. To provide an opportunity to correct such errors, I am proposing a new provision permitting taxpayers to file an Updated Return on payment of additional tax. This updated return can be filed within two years from the end of the relevant assessment year.

- Presently, if the department finds out that some income has been missed out by the assessee, it goes through a lengthy process of adjudication. Instead, with this proposal now, there will be a trust reposed in the taxpayers that will enable the assessee herself to declare the income that she may have missed out earlier while filing her return. Full details of the proposal are given in the Finance Bill. It is an affirmative step in the direction of voluntary tax compliance.

Reduced Alternate minimum tax rate and Surcharge for Cooperatives

- Currently, cooperative societies are required to pay Alternate Minimum Tax at the rate of eighteen and one half per cent. However, companies pay the same at the rate of fifteen per cent. To provide a level playing field between co-operative societies and companies, I, propose to reduce this rate for the cooperative societies also to fifteen per cent.

- I also propose to reduce the surcharge on co-operative societies from present 12 per cent to 7 per cent for those having total income of more than ` 1 crore and up to ` 10 crores.

- This would help in enhancing the income of cooperative societies and its members who are mostly from rural and farming communities.

Tax relief to persons with disability

- The parent or guardian of a differently abled person can take an insurance scheme for such person. The present law provides for deduction to the parent or guardian only if the lump sum payment or annuity is available to the differently abled person on the death of the subscriber i.e. parent or guardian.

- There could be situations where differently abled dependants may need payment of annuity or lump sum amount even during the lifetime of their parents/guardians. I propose to thus allow the payment of annuity and lump sum amount to the differently abled dependent during the lifetime of parents/guardians, i.e., on parents/ guardians attaining the age of sixty years.

Parity between employees of State and Central government

- At present, the Central Government contributes 14 per cent of the salary of its employee to the National Pension System (NPS) Tier-I. This is allowed as a deduction in computing the income of the employee.

However, such deduction is allowed only to the extent of 10 per cent of the salary in case of employees of the State government. To provide equal treatment to both Central and State government employees, I propose to increase the tax deduction limit from 10 per cent to 14 per cent on employer’s contribution to the NPS account of State Government employees as well. This would help in enhancing the social security benefits of the state government employees and bring them at par with central government employees. Incentives for Start-ups

- Start-ups have emerged as drivers of growth for our economy. Over the past few years, the country has seen a manifold increase in successful start-ups. Eligible start-ups established before 31.3.2022 had been provided a tax incentive for three consecutive years out of ten years from incorporation. In view of the Covid pandemic, I propose to extend the period of incorporation of the eligible start-up by one more year, that is, up to 31.03.2023 for providing such tax incentive.

Incentives for newly incorporated manufacturing entities under concessional tax regime

- In an effort to establish a globally competitive business environment for certain domestic companies, a concessional tax regime of 15 per cent tax was introduced by our government for newly incorporated domestic manufacturing companies. I propose to extend the last date for commencement of manufacturing or production under section 115BAB by one year i.e. from 31st March, 2023 to 31st March, 2024. Scheme for taxation of virtual digital assets

- There has been a phenomenal increase in transactions in virtual digital assets. The magnitude and frequency of these transactions have made it imperative to provide for a specific tax regime. Accordingly, for the taxation of virtual digital assets, I propose to provide that any income from transfer of any virtual digital asset shall be taxed at the rate of 30 per cent.

* No deduction in respect of any expenditure or allowance shall be allowed while computing such income except cost of acquisition. Further, loss from transfer of virtual digital asset cannot be set off against any other income.

* Further, in order to capture the transaction details, I also propose to provide for TDS on payment made in relation to transfer of virtual digital asset at the rate of 1 per cent of such consideration above a monetary threshold.

* Gift of virtual digital asset is also proposed to be taxed in the hands of the recipient.

Litigation management to avoid repetitive appeals by the Department

- It has been observed that a lot of time and resources are consumed in filing of appeals which involve identical issues. Taking forward our policy of sound litigation management, I propose to provide that, if a question of law in the case of an assessee is identical to a question of law which is pending in appeal before the jurisdictional High Court or the Supreme Court in any case, the filing of further appeal in the case of this assessee by the department shall be deferred till such question of law is decided by the jurisdictional High Court or the Supreme Court. This will greatly help in reducing the repeated litigation between taxpayers and the department.

Tax incentives to IFSC

- Taking forward our efforts to further promote the IFSC, I hereby propose to provide that income of a non-resident from offshore derivative instruments, or over the counter derivatives issued by an offshore banking unit, income from royalty and interest on account of lease of ship and income received from portfolio management services in IFSC shall be exempt from tax, subject to specified conditions.

- Rationalization of Surcharge

* In the globalized business world, there are several works contracts whose terms and conditions mandatorily require formation of a consortium. The members in the consortium are generally companies. In such cases, the income of these AOPs has to suffer a graded surcharge upto 37 per cent, which is a lot more than the surcharge on the individual companies. Accordingly, I propose to cap the Surcharge of these AOP’s at 15 per cent.

* Further, the long-term capital gains on listed equity shares, units etc. are liable to maximum surcharge of 15 per cent, while the other long term capital gains are subjected to a graded surcharge which goes up to 37 per cent. I propose to cap the surcharge on long term capital gains arising on transfer of any type of assets at 15 per cent. This step will give a boost to the start up community and along with my proposal on extending tax benefits to manufacturing companies and start ups re affirms our commitment to Atma Nirbhar Bharat.

Clarification in relation to ‘Health and Education cess’ as business expenditure

- The income-tax is not an allowable expenditure for computation of business income. This includes tax as well as surcharges. The ‘Health and Education Cess’ is imposed as an additional surcharge on the taxpayer for funding specific government welfare programs. However, some courts have allowed ‘Health and education ‘cess’ as business expenditure, which is against the legislative intent. To reiterate the legislative intent, I propose to clarify that any surcharge or cess on income and profits is not allowable as business expenditure.

Deterrence against tax-evasion:

- Presently, there is ambiguity regarding set off, of brought forward loss against undisclosed income detected in search operations. It has been observed that in many cases where undisclosed income or suppression of sales etc. is detected, payment of tax is avoided by setting off, of losses. In order to bring certainty and to increase deterrence among tax evaders, I propose to provide that no set off, of any loss shall be allowed against undisclosed income detected during search and survey operations.

Rationalizing TDS Provisions

- It has been noticed that as a business promotion strategy, there is a tendency on businesses to pass on benefits to their agents. Such benefits are taxable in the hands of the agents. In order to track such transactions, I propose to provide for tax deduction by the person giving benefits, if the aggregate value of such benefits exceeds ` 20,000 during the financial year.

- A few other changes are being made the details of which are there in the Finance Bill.

Indirect taxes Remarkable progress in GST:

- GST has been a landmark reform of Independent India showcasing the spirit of Cooperative Federalism. While aspirations were high, there were huge challenges too. These challenges were overcome deftly and painstakingly under the guidance and oversight of the GST Council. We can now take pride in a fully IT driven and progressive GST regime that has fulfilled the cherished dream of India as one market- one tax. There are still some challenges remaining and we aspire to meet them in the coming year. The right balance between facilitation and enforcement has engendered significantly better compliance. GST revenues are buoyant despite the pandemic. Taxpayers deserve applause for this growth. Not only did they adapt to the changes but enthusiastically contributed to the cause by paying taxes.

Special Economic Zones:

- In Part A of my speech, I have referred to the proposed reforms in SEZs. Alongside, we will also undertake reforms in Customs Administration of SEZs and it shall henceforth be fully IT driven and function on the Customs National Portal with a focus on higher facilitation and with only risk-based checks. This will ease doing business by SEZ units considerably. This reform shall be implemented by 30th September 2022.

Customs Reforms and duty rate changes

- Customs administration has reinvented itself over the years through liberalised procedures and infusion of technology. Faceless Customs has been fully established. During Covid-19 pandemic, Customs formations have done exceptional frontline work against all odds displaying agility and purpose. Customs’ reforms have played a very vital role in domestic capacity creation, providing level playing field to our MSMEs, easing the raw material supply side constraints, enhancing ease of doing business and being an enabler to other policy initiatives such as PLIs and Phased Manufacturing Plans. My proposals on customs side are aligned to these objectives.

Project imports and capital goods

- National Capital Goods Policy, 2016 aims at doubling the production of capital goods by 2025. This would create employment opportunities and result in increased economic activity. However, several duty exemptions, even extending to over three decades in some cases, have been granted to capital goods for various sectors like power, fertilizer, textiles, leather, footwear, food processing and fertilizers. These exemptions have hindered the growth of the domestic capital goods sector.

- Similarly, project import duty concessions have also deprived the local producers of a level playing field in areas like coal mining projects, power generation, transmission or distribution projects, railway and metro projects. Our experience suggests that reasonable tariffs are conducive to the growth of domestic industry and ‘Make in India’ without significantly impacting the cost of essential imports.

- Accordingly, it is proposed to phase out the concessional rates in capital goods and project imports gradually and apply a moderate tariff of 7.5 per cent. Certain exemptions for advanced machineries that are not manufactured within the country shall continue.

- A few exemptions are being introduced on inputs, like specialised castings, ball screw and linear motion guide, to encourage domestic manufacturing of capital goods.

Review of customs exemptions and tariff simplification

- In the last two budgets we have rationalised several customs exemptions. We have once again carried out an extensive consultation, including by crowd sourcing and as a result of these consultations, more than 350 exemption entries are proposed to be gradually phased out. These include exemption on certain agricultural produce, chemicals, fabrics, medical devices and drugs and medicines for which sufficient domestic capacity exists. Further, as a simplification measure, several concessional rates are being incorporated in the Customs Tariff Schedule itself instead of prescribing them through various notifications.

- This comprehensive review will simplify the Customs rate and tariff structure particularly for sectors like chemicals, textiles and metals and minimise disputes. Removal of exemption on items which are or can be manufactured in India and providing concessional duties on raw material that go into manufacturing of intermediate products will go many a step forward in achieving our objective of ‘Make in India’ and ‘Atmanirbhar Bharat’.

- I shall now take up sector specific proposals.

Electronics

- Electronic manufacturing has been growing rapidly. Customs duty rates are being calibrated to provide a graded rate structure to facilitate domestic manufacturing of wearable devices, hearable devices and electronic smart meters. Duty concessions are also being given to parts of transformer of mobile phone chargers and camera lens of mobile camera module and certain other items. This will enable domestic manufacturing of high growth electronic items.

Gems and Jewellery

- To give a boost to the Gems and Jewellery sector, Customs duty on cut and polished diamonds and gemstones is being reduced to 5 per cent. Simply sawn diamond would attract nil customs duty. To facilitate export of jewellery through e-commerce, a simplified regulatory framework shall be implemented by June this year. To disincentivise import of undervalued imitation jewellery, the customs duty on imitation jewellery is being prescribed in a manner that a duty of at least ` 400 per Kg is paid on its import.

Chemicals:

- Customs duty on certain critical chemicals namely methanol, acetic acid and heavy feed stocks for petroleum refining are being reduced, while duty is being raised on sodium cyanide for which adequate domestic capacity exists. These changes will help in enhancing domestic value addition.

MSME

- Duty on umbrellas is being raised to 20 per cent. Exemption to parts of umbrellas is being withdrawn. Exemption is also being rationalised on implements and tools for agri-sector which are manufactured in India. Customs duty exemption given to steel scrap last year is being extended for another year to provide relief to MSME secondary steel producers. Certain Anti- dumping and CVD on stainless steel and coated steel flat products, bars of alloy steel and high-speed steel are being revoked in larger public interest considering prevailing high prices of metals.

Exports

- To incentivise exports, exemptions are being provided on items such as embellishment, trimming, fasteners, buttons, zipper, lining material, specified leather, furniture fittings and packaging boxes that may be needed by bonafide exporters of handicrafts, textiles and leather garments, leather footwear and other goods.

- Duty is being reduced on certain inputs required for shrimp aquaculture so as to promote its exports.

Tariff measure to encourage blending of fuel

- Blending of fuel is a priority of this Government. To encourage the efforts for blending of fuel, unblended fuel shall attract an additional differential excise duty of ` 2/ litre from the 1st day of October 2022.

- A few other changes are being made in duty rates, Customs Tariff and Customs Law the details of which are there in the

Finance Bill.

- Mr Speaker Sir, with these words I commend the budget to this august house.

Innovating Excellence: The Story of Dr. Sahebgowda Shetty, Founder of Dr. Shetty’s Cosmetic Centre.

Innovating Excellence: The Story of Dr. Sahebgowda Shetty, Founder of Dr. Shetty’s Cosmetic Centre.  Dr Pradeep Panigrahy raises the sustainable growth of nuclear energy in the country in Lok Sabha

Dr Pradeep Panigrahy raises the sustainable growth of nuclear energy in the country in Lok Sabha  India Leadership Conclave 2024 Debates Democracy, Governance.

India Leadership Conclave 2024 Debates Democracy, Governance.  Troubled Global business tycoon Adani in Talks to Prepay Share Pledges to Boost Confidence

Troubled Global business tycoon Adani in Talks to Prepay Share Pledges to Boost Confidence  Gautam Adani loses rankings in world’s top 20 richest people as Adani Group sheds $108 billion in market value

Gautam Adani loses rankings in world’s top 20 richest people as Adani Group sheds $108 billion in market value  Union Budget for 2023-24 pegs country’s economic growth for current FY at seven percent

Union Budget for 2023-24 pegs country’s economic growth for current FY at seven percent