Indian Economy must embrace necessary changes to grow at faster speed

Economists of a certain vintage will remember the old development models in which rapid economic growth was held back by three key constraints.

The first was the savings constraint. A poor country such as India could not save enough of its annual national income to sustain high rates of investment. The lack of domestic savings was without doubt the most serious constraint to economic growth in the early decades after political independence.

The second was the foreign exchange constraint. This lack of hard currency to import the capital equipment needed to build new industrial capacity led to the Nehruvian quest to build a domestic capital goods industry ahead of a consumer goods industry.

The third was the food constraint. The Mumbai critics of the Mahalanobis plans had warned that the impact of the lack of wage goods would be inflationary as money incomes went up. The mainstream plan models optimistically considered agriculture as a bargain sector in which production could be increased with minimal investment.

Each of these constraints has eased as the decades went by. India now has a savings rate that compares well with those in the East Asian economies during their economic accelerations. Foreign exchange is no longer scarce; the Reserve Bank of India has a huge pile of hard currency.

And what about the food constraint? In some of his recent writings in The Indian Express, Harish Damodaran has put forth a fascinating hypothesis that Indian agriculture has now entered a new era of permanent surpluses. He argues that new seeds plus faster diffusion of new technology has changed the traditional dynamics of production in crops ranging from pulses to vegetables to sugar to wheat. “The flip side of a more elastic supply curve, however, is that it makes gluts commonplace and shortages temporary”, Damodaran wrote last month.

Much of the current discussion has remained focused on the immediate implications of such permanent agricultural surpluses. However, the key question over the longer term is whether it is time to say that the old food constraint on Indian economic growth has now disappeared and then ask what this could mean for Indian macroeconomics.

The wage-goods constraint was acutely felt in the 1965-1980 period. It is no surprise that these were also the years of industrial stagnation. One group of Indian economists had argued at the time that the two were intimately connected. Industrial stagnation was linked to the food constraint. Higher food prices were pushing up industrial wages more rapidly than underlying productivity. The result was a profits squeeze that hurt investment in new capacity.

An alternative view was that the problem was actually quite the opposite. A lack of purchasing power in the rural areas was restricting the demand for industrial goods in India. A shift in domestic terms of trade in favour of agriculture would act as a stimulus to consumer demand. The first view was led by the supply side while the second view looked at the problem from the demand side. Tangentially, it is worth pointing out that the Nehruvian plans had a firm supply-side bias.

These old debates will now only interest economic historians. However, they do have some resonance in our times. One key issue that Indian policy thinkers will have to grapple with in the era of agricultural surpluses is whether low food prices will help industrial profits by keeping wage growth under control, or whether they will hurt industrial growth because of a collapse in rural demand. The link between the food and industrial sectors does not get the attention it deserves.

The related issue is whether the diversification of the rural economy in recent years—a recent paper written for the NITI Aayog by Ramesh Chand, S.K. Srivastava and Jaspal Singh shows that more than half of Indian industrial production comes from the rural areas—means that a more granular view of the impact of structural food surpluses may be needed. In a landmark work published in 1976, economist Ashok Mitra, who later became finance minister of West Bengal, had shown through careful empirical work that changes in food prices affect various social groups differently: “While the shift in the terms of trade has implied a shift in real incomes in favour of the farming community considered as an aggregate vis-a-vis the rest of the nation, the resulting gains have been exclusively monopolised by the surplus-raising farmers and their trading partners; landless labourers and small farmers, who are net purchasers of grains from the market, have been as adversely affected by the rise in farm prices as the non-agricultural classes in general.”

The structural shift in Indian agriculture from intermittent shortages to permanent surpluses could thus have profound implications for the Indian economy. The three main constraints that dominated development thinking in the first decades after independence—the savings constraint, the foreign exchange constraint, the food constraint—are now history. The nature of constraints have now changed, as is only to be expected in any rapidly growing economy—infrastructure bottlenecks, institutional rigidities, human capital limitations.

The job of policy strategists is always to identify the binding constraints to growth and then try to figure out which policies will help ease them. Some more of that intellectual work is needed right now.

Pharma Leaders 2026 : Reimagining Healthcare – Powering Trust, Innovation & Global Impact

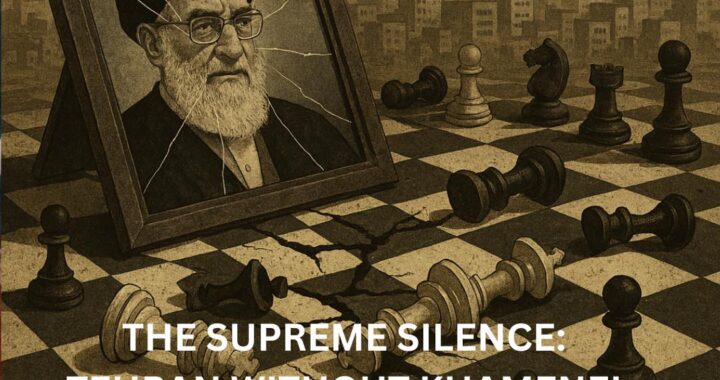

Pharma Leaders 2026 : Reimagining Healthcare – Powering Trust, Innovation & Global Impact  The Earthquake in Tehran: Khamenei’s Death and the Shattered Chessboard

The Earthquake in Tehran: Khamenei’s Death and the Shattered Chessboard  From Generics to Genius: India’s Pharma Awakens to Global Leadership

From Generics to Genius: India’s Pharma Awakens to Global Leadership  Shashi Tharoor Tears Into Union Budget 2026–27: “Promises Without Commitment”

Shashi Tharoor Tears Into Union Budget 2026–27: “Promises Without Commitment”  Union Budget 2026: Growth for Bharat, Relief Deferred!

Union Budget 2026: Growth for Bharat, Relief Deferred!  Budget 2026: Nirmala Sitharaman’s Tightrope Walk Between Growth and Justice

Budget 2026: Nirmala Sitharaman’s Tightrope Walk Between Growth and Justice