Indian funds seek to reassure investors after shutdowns fuel redemption fears. The industry continues to remain robust. AMFI chairman Nilesh Shah

MUMBAI – Fund houses in India were battling to reassure investors on Friday, amid fears of a flood of redemption requests after the unprecedented closure of six debt funds by global giant Franklin Templeton.

Franklin Templeton Mutual Fund, one of India’s most prominent mutual fund houses in fixed income, said on Thursday it would wind up six credit funds in India with large exposures to higher-yielding, lower-rated credit securities due to a lack of liquidity amid the coronavirus pandemic.

The closures sparked worries of panic withdrawals from other Franklin Templeton funds as well as credit funds of other asset managers, and triggered a storm on social media with distraught investors calling for regulators to step in.

“It is just like a run on banks. Across debt mutual funds, there will be loss of trust,” said Omkeshwar Singh, head of mutual fund advisory firm RankMF.

“Earlier, only corporates were taking out money for cash management. Now, high net worth individuals will go for panic redemption,” he said.

The Association of Mutual Funds in India (AMFI) said on Friday debt schemes of most mutual funds had “superior credit quality” and were “fairly liquid”. It called on investors to “not get side-tracked by an isolated event”.

“There is no need for (investors) to panic and redeem their investments,” AMFI chairman Nilesh Shah said in a statement. “The industry continues to remain robust.”

Several top mutual fund houses, including Aditya Birla and HDFC, also rushed to hold conference calls with their investors in an effort to reassure them about their portfolios.

The six funds shut by Franklin Templeton have total assets under management of about 280 billion rupees (or close to $4 billion) that will be stuck until the market normalises.

With assets worth over 860 billion rupees as of the end of March, Franklin Templeton is the ninth largest mutual fund in India, having set up shop over two decades ago.

Franklin Templeton was long known for its focus on lower-rated papers such as “AA” or “A” and in turn higher yields for its investors.

But the tide changed as a string of defaults by a large infrastructure lender in late 2018 led to liquidity in the corporate bond market drying up. That was exacerbated as an economic slowdown triggered more debt defaults last year.

Redemptions then soared as many investors looked to preserve cash amid a nationwide lockdown to contain the spread of the coronavirus. Last month, mutual funds investing in debt papers saw outflows of close to 1.95 trillion rupees ($25.5 billion).

But with no demand, Templeton’s lower-rated papers wouldn’t have generated a good enough price in the bond market, forcing it to shut down the funds. (Reuters)

Gautam Adani loses rankings in world’s top 20 richest people as Adani Group sheds $108 billion in market value

Gautam Adani loses rankings in world’s top 20 richest people as Adani Group sheds $108 billion in market value  Prof. Dr. Kannan Vishwanatth floors the V International Economic Forum at Riga, Latvia on The COVID Crisis and Opportunities for Human Well-Being.

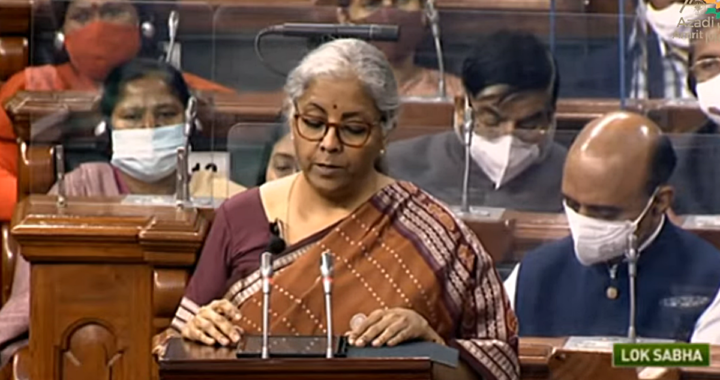

Prof. Dr. Kannan Vishwanatth floors the V International Economic Forum at Riga, Latvia on The COVID Crisis and Opportunities for Human Well-Being.  Finance Minister Nirmala Sitharaman Budget 2022-23 focusses on Infrastructure & big push for AatamNirbhar Bharat

Finance Minister Nirmala Sitharaman Budget 2022-23 focusses on Infrastructure & big push for AatamNirbhar Bharat  Network 7 Media Group’s India Leadership Conclave 2021 to debate Reforms, Honour shining stars of Indian Inc.

Network 7 Media Group’s India Leadership Conclave 2021 to debate Reforms, Honour shining stars of Indian Inc.  Finance Minister Nirmala Sitharaman assures Farmers on MSP, says Govt committed!

Finance Minister Nirmala Sitharaman assures Farmers on MSP, says Govt committed!  Infosys to Acquire Product Design and Development firm, Kaleidoscope Innovation

Infosys to Acquire Product Design and Development firm, Kaleidoscope Innovation