Loan moratorium: Going any further from relief announced would be detrimental to economy, Centre tells SC

New Delhi, Oct 10. The Centre has told the Supreme Court that going any further than the fiscal policy decisions already taken, such as waiver of compound interest charged on loans of up to Rs 2 crore for six months moratorium period, may be “detrimental” to the overall economic scenario, the national economy and banks may not take “inevitable financial constraints”.

The Union Finance Ministry, through its additional secretary Pankaj Jain, filed the affidavit in compliance of the top court”s October 5 order asking it to place on record the K V Kamath Committee recommendations on debt restructuring in view of COVID-19 related stress on various sectors as well as the notifications and circulars issued so far on the loan moratorium and financial difficulties.

Prior to this, the Centre had told the top court that it has decided to waive compound interest (interest on interest) charged on loans of up to Rs 2 crores for a six-month moratorium period announced due to the pandemic from individual borrowers in eight categories – MSME, Education loan, Housing Loan, consumer durable loan, credit card dues, auto loan, personal loans to professionals and consumption loans.

The court, on October 5, had observed that the Centre”s affidavit did not contain necessary details and had asked the Centre and the RBI to file fresh ones in the case.

In the fresh affidavit, the Centre referred to its various fiscal policy decisions and the Reserve Bank of India and expressed inability in expanding the scope of reliefs already provided to different sectors.

“It is… submitted that while taking… decision and to supplement the earlier fiscal policy decisions under the ”Garib Kalyan” and ”Aatma Nirbhar” packages entailing substantial financial burden, the respondent government has rationalised the fiscal impact of the same, and that going any further than what has been decided and submitted to the hon”ble court may be detrimental to the overall economic scenario, and the national economy or the banking sector may not be able to take the inevitable financial constraints resulting therefrom.”

The official said the Centre”s decision with regard to the question of waiver of interest on interest to bear the burden of compounding of interest in respect of certain categories of loans was taken in the larger public interest only in the specific context of the pandemic, which is, by itself, an unprecedented situation.

Such fiscal policy decisions are taken after an elaborate exercise of gathering of facts, careful assessment of these facts and considering various alternatives, keeping in mind the economic impact on financial strength of stakeholders and all other relevant factors, more particularly during the pandemic when the global fiscal scenario is equally bad and the fact that it is uncertain as to till what date the present global and national economic stress will continue, the affidavit said.

The Centre said that the recommendations of the Kamath Committee have been broadly accepted by the RBI and the panel found “variable impact of the pandemic across several sectors, with varying degrees of severity and varying nature of problems”.

“A perusal of the entire report would show that it is neither possible nor desirable to arrive at any one particular formula, whether sector-specific or otherwise, to deal with the stress situation arising from the unprecedented pandemic,” it said.

The Kamath panel had made recommendations for 26 sectors that could be factored by lending institutions while finalising loan resolution plans and had said that banks could adopt a graded approach based on the severity of the coronavirus pandemic on a sector.

It said that the government extended relief through the “Garib Kalyan package of Rs 1.70 lakh crore and the Aatma Nirbhar package.. of Rs. 20 lakh crore” and various measures have also been taken by RBI to mitigate the adverse financial impact.

It said relief such as “extension of moratorium, applicability of the resolution framework, fixation of interest rate, transmission of rate cuts, delinking of interest rate from credit rating of the borrower and moratorium on repayment of non-credit instruments” have been sought in the petitions.

“This, in turn, requires expertise, technical knowledge of financing, and experience in dealing with the subject. Therefore, eligibility of proposals, benchmarks for viability, assessment of reasonableness of assumptions and, finally, acceptance and monitoring of resolution plans are matters best dealt with between the borrower and lending institutions concerned,” it said and urged the court not entertain such pleas.

“I state that the lending institutions will be required to take suitable steps for implementing the decision of waiver of interest on interest [compounded interest] in the respective accounts of the eligible borrowers within one month from the aforesaid office memorandum subsequent to which the lending institution will approached the Central Government for reimbursement,” it said.

Earlier during the day, RBI filed the affidavit saying a moratorium period exceeding six months might result in “vitiating the overall credit discipline” which would have a “debilitating impact” on the process of credit creation in the economy.

The top court is hearing a batch of pleas, including the one which has sought a direction to declare the portion of RBI”s March 27 notification “as ultra vires to the extent it charges interest on the loan amount during the moratorium period, which create hardship to the petitioner being borrower and creates hindrance and obstruction in ”right to life” guaranteed by Article 21 of the Constitution”. PTI

Innovating Excellence: The Story of Dr. Sahebgowda Shetty, Founder of Dr. Shetty’s Cosmetic Centre.

Innovating Excellence: The Story of Dr. Sahebgowda Shetty, Founder of Dr. Shetty’s Cosmetic Centre.  Actress Leslie Tripathy at India Leadership Conclave 2014

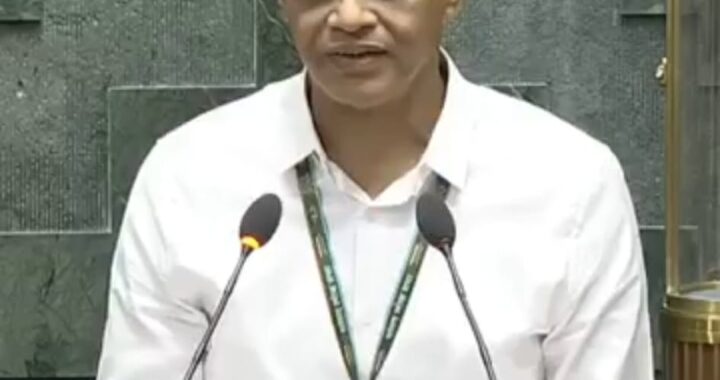

Actress Leslie Tripathy at India Leadership Conclave 2014  Dr Pradeep Panigrahy raises the sustainable growth of nuclear energy in the country in Lok Sabha

Dr Pradeep Panigrahy raises the sustainable growth of nuclear energy in the country in Lok Sabha  India Leadership Conclave 2024 Debates Democracy, Governance.

India Leadership Conclave 2024 Debates Democracy, Governance.  Actress Karnika Singh dons Sci Fi Character in India’s 1st Virtual Reality Sci-Fi film Movie STARGATE

Actress Karnika Singh dons Sci Fi Character in India’s 1st Virtual Reality Sci-Fi film Movie STARGATE  Troubled Global business tycoon Adani in Talks to Prepay Share Pledges to Boost Confidence

Troubled Global business tycoon Adani in Talks to Prepay Share Pledges to Boost Confidence