World economy at its worst due to COVID-19. We have reassessed the prospect for growth for 2020 and 2021. It is now clear that we have entered a recession – as bad as or worse than in 2009 – IMF Chief

COVID-19 on the global economy is the risk of a wave of bankruptcies and layoffs capable of eroding the fabric of the societies.

The world’s economy has entered a recession and requires massive funding to help developing nations, Ms Kristalina Georgieva has declared.

Georgieva, the Managing Director of the International Monetary Fund (IMF), explained that this was as a result of the coronavirus (COVID-19) pandemic that has killed thousands of people around the world.

She stated this on Friday at a press briefing following a Conference Call of the IMF and Financial Committee (IMFC).

.@KGeorgieva: It is now clear that we have entered a recession. We project a rebound in 2021, but only if we contain the virus and prevent liquidity problems from becoming a solvency issue. https://t.co/dg8FHiuftW #COVID19 pic.twitter.com/BIbFaRB48u— IMF (@IMFNews) March 27, 2020

“We have reassessed the prospect for growth for 2020 and 2021. It is now clear that we have entered a recession – as bad as or worse than in 2009,” Georgieva announced.

She added, “We do project recovery in 2021 – in fact, there may be a sizeable rebound, but only if we succeed with containing the virus – everywhere – and prevent liquidity problems from becoming a solvency issue.”

The IMF chief noted that IMFC, the governing body of the organisation representing 189 member countries, met earlier to discuss the threat posed to the world by coronavirus.

According to her, a major concern about the effect of COVID-19 on the global economy is the risk of a wave of bankruptcies and layoffs capable of eroding the fabric of the societies.

Georgieva, however, noted that many countries have taken measures to prevent this by address the crisis in their health sector.

Read the remarks by the IMF chief below:

Good morning. The governing body of the IMF—the International Monetary and Financial Committee (IMFC), representing our 189 member countries— met today to discuss the unprecedented challenge posed to the world by COVID-19.

Following yesterday’s G20 Leaders meeting, the IMFC took stock of the rapidly developing health crisis, its impact on the economy, measures taken to address these impacts, and how well the Fund is equipped to help its member countries.

I noted that since the IMFC last met just a few weeks ago:

We have reassessed the prospect for growth for 2020 and 2021. It is now clear that we have entered a recession – as bad as or worse than in 2009.

We do project recovery in 2021–in fact, there may be a sizeable rebound, but only if we succeed with containing the virus – everywhere – and prevent liquidity problems from becoming a solvency issue.

A key concern about a long-lasting impact of the sudden stop of the world economy is the risk of a wave of bankruptcies and layoffs that not only can undermine the recovery but can erode the fabric of our societies.

To avoid this happening, many countries have taken far-reaching measures to address the health crisis and to cushion its impact on the economy – both on the monetary and on the fiscal side.

The G20 yesterday reported fiscal measures totalling some 5 trillion dollars or over 6 % of global GDP. It is important for those ahead in taking action to share their experience with those still behind.

To support this, last night the IMF launched a policy actions tracker for 186 countries to help us all to see who is doing what.

We will be updating this information regularly and will provide country-specific analysis in line with our surveillance mandate.

We have seen an extraordinary spike in requests for IMF emergency financing – some 80 countries have placed requests and more are likely to come.

Normally, we never have more than a handful of requests at the same time. Yesterday our Executive Board approved the first of these emergency requests for the Kyrgyz Republic, a record fast disbursement.

We also see a wide range of problems building up in emerging markets – the spread of the virus, the shut-down of economies, capital outflows and – for commodity exporters – a price shock.

Many of these emerging markets will experience a contraction as necessary containment measures take their toll, and are shocked by reduced global demand for their exports – tourism, commodities, and manufactured goods – that provide critical streams of foreign exchange.

Our current estimate for the financial needs of emerging markets is $2.5 trillion – a lower-end estimate for which their own reserves and domestic resources would not be sufficient.

We are being asked by our members to do more, do it better, and do it faster than ever before – and to do it in collaboration with the World Bank and our other partners.

How can we meet that challenge? Specifics:

First, we are proposing to double our emergency financing capacity; simplify our processes; and fill the gap in our concessional financing.

Second, we are reviewing our lending instruments to see what might be missing in the context of this crisis and so that we can design an appropriate response.

For example, can we expand the use of precautionary credit lines? Can we bring forward short-term liquidity provisions? We want countries to approach the Fund and access the tools they require for the needs they have.

The sooner countries can approach us, obtain necessary financing, and implement good policy, the better chance we have to contain the damage and move towards recovery.

Third, many of our member countries are faced with rapidly building pressures on debt which they need to address. On that note, our Board yesterday approved changes in the application of the Catastrophe Containment and Relief Trust (CCRT) which can provide some debt relief to our poorest member countries.

We are seeking support from our membership to increase the capacity of the CCRT. We have received pledges of support from the U.K., Japan and China —and we hope others will follow quickly.

Last but not least, we need urgently to secure the borrowing capacity of the Fund through the NABs (New Arrangements to Borrow) and bilateral borrowing arrangements.

In this context, it’s very encouraging that NAB approval is part of the US stimulus package that is before the US Congress. We need other countries which have not yet done so, to follow suit.

So next steps: the IMFC charged us to discuss these various options further with our Executive Board with a view to having a concrete package of proposals for IMFC consideration at our Spring Meetings in a few weeks’ time.

So it’s all hands on deck at the IMF and working very hard to strengthen our crisis response capacity as much as possible.

Thank you.

Gautam Adani loses rankings in world’s top 20 richest people as Adani Group sheds $108 billion in market value

Gautam Adani loses rankings in world’s top 20 richest people as Adani Group sheds $108 billion in market value  Prof. Dr. Kannan Vishwanatth floors the V International Economic Forum at Riga, Latvia on The COVID Crisis and Opportunities for Human Well-Being.

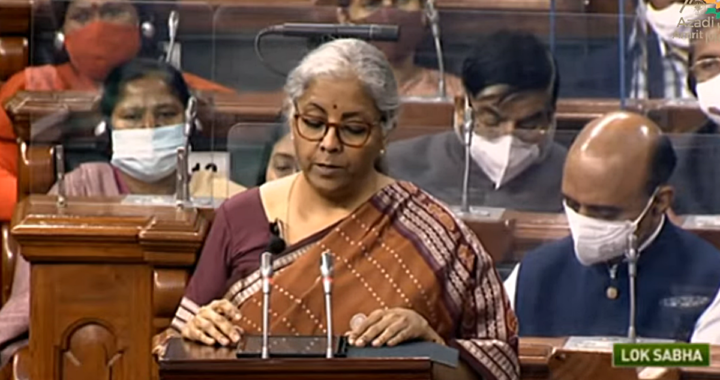

Prof. Dr. Kannan Vishwanatth floors the V International Economic Forum at Riga, Latvia on The COVID Crisis and Opportunities for Human Well-Being.  Finance Minister Nirmala Sitharaman Budget 2022-23 focusses on Infrastructure & big push for AatamNirbhar Bharat

Finance Minister Nirmala Sitharaman Budget 2022-23 focusses on Infrastructure & big push for AatamNirbhar Bharat  Network 7 Media Group’s India Leadership Conclave 2021 to debate Reforms, Honour shining stars of Indian Inc.

Network 7 Media Group’s India Leadership Conclave 2021 to debate Reforms, Honour shining stars of Indian Inc.  Finance Minister Nirmala Sitharaman assures Farmers on MSP, says Govt committed!

Finance Minister Nirmala Sitharaman assures Farmers on MSP, says Govt committed!  Infosys to Acquire Product Design and Development firm, Kaleidoscope Innovation

Infosys to Acquire Product Design and Development firm, Kaleidoscope Innovation