India’s manufacturing process could make Trump Healthcare in bringing down health costs in United States – Satya Brahma

India’s manufacturing process could make Trump Healthcare in bringing down health costs in United States.

India’s Innovation & Technology Expertise will make Donald Trump Healthcare Policy in India Affordable & Accessible. It is also true that given the challenges in the US market and the size of the base business, companies need to transition toward more innovative and complex portfolios. The US healthcare sector’s dependence on generics will continue and there may not be much to be concerned about as far as the Indian pharma sector is concerned, since it is in the Us’ best interest to bring down costs

India’s largest drugmakers are making a case that the U.S. should import cheap Indian-made drugs to hold down healthcare costs, and partner with its pharma leaders to develop inexpensive biosimilars. But Indian pharma companies have a less-than-stellar track record with the FDA on manufacturing quality, and that is casting a cloud over the country’s efforts to partner with President Donald Trump as he pushes to lower drug prices.

Trump’s rhetoric in the early days of his administration has included blasting U.S. pharma companies for manufacturing drugs overseas and “getting away with murder” on pricing. Republican lawmakers have suggested a border tax on imports in an effort to shift manufacturing jobs back to the U.S.

The possibility of the United States cracking down on import of generic medicines from India as part of President Donald Trump’s proposed protectionist measures has left some of the biggest Indian pharma companies worried. “India can look for and may get an opportunity to fill the void created by abolition of Obamacare but it will not come easily. The future is not predictable. Irrespective of which way the Trump administration moves, it is certain that exports of generics from India would be hit

On the back of Indian pharma players contributing the most to FDA’s generic drug user fee – the payment generic players pay to US regulators to clear the applications – they expect a preferential treatment to filings from India. IPA data demonstrates that since 2010, Indian pharma investment in US has gone up by over 500% from Rs 4,627 crore to Rs 25,133 crore.

Indian drug companies have built their fortunes by making US one of their key export markets. Currently, over 40% of the four top Indian drugmakers’ revenues comes from the US market. However, in the past few years companies have come under FDA scrutiny for non-compliance of good manufacturing practices. Players like WockhardtBSE 0.97 % have stopped most of their exports to US after repeated FDA bans. Flagship units of Sun and DRL too are facing regulatory scrutiny.

Despite the initial skepticism visible in the stock markets with respect to the future performance of Indian pharmaceutical companies, industry insiders say that Donald Trump’s presidency will not have much impact on their fortunes. By Wednesday afternoon, construction tycoon and Republican candidate Donald Trump was announced as US’ President-elect, as his opponent and Democrat Hillary Clinton conceded defeat. In the analysis and speculation that had built up till Wednesday’s verdict, it was widely anticipated that Secretary of State in the current Barack Obama administration, Clinton will be US’ next President. But as the results of the polls from various US states started pouring in, the tide increasingly turned in Trump’s favour.

Pharma sector experts were of the opinion that a potential government with Clinton at the helm may have sought to curb the profits raked in by generic pharma companies that cater to the US market, the world’s largest for generic drugs, which are versions of innovator medicines that lose patent protection. This, analysts believed, would lead to a pressure on the pricing power that drug-makers enjoy in the US.Indian pharma companies comprise the largest set of generic drug suppliers to the US, accounting for as much as 40 percent of the supply of such medicines. A major development in recent times that led to this line of thought was news of the US beginning a grand jury probe into instances of possible price cartelization by pharma companies – the fallout of an anti-trust investigation being conducted by the US Department of Justice (DoJ), which began around two years ago. As a part of this investigation, several marquee global pharma companies like Teva Pharmaceutical Industries, Allergan (acquired by Teva Pharmaceutical Industries from Actavis in August), and Mylan, among others, have been served subpoenas demanding explanation for price hike actions taken. Indian companies that fall within the ambit of the DoJ investigation include Sun Pharmaceutical Industries and Dr. Reddy’s Laboratories.

Trump, a successful businessman in his own right, is expected to be more business-friendly given his own entrepreneurial experience and belief in free market dynamics, which could work to the benefit of pharma companies. In his victory speech on Wednesday, Trump, 70, said that his presidency will focus on creating infrastructure and generating employment for the people of the US. He is also in a good position to do so since his Republican Party will also control the US Senate, which could facilitate smoother decision-making. Consequently, if Trump incentivizes manufacturing of drugs in the US, it may work to the benefit of Indian pharma companies like Sun Pharmaceutical Industries, Cipla, Dr. Reddy’s Laboratories and Lupin, which have a manufacturing presence in the US.

Rosetta Hospitality Crowned India’s Crown Jewel in Luxury Hospitality of the Year 2025 at ILC Power Brand Awards

Rosetta Hospitality Crowned India’s Crown Jewel in Luxury Hospitality of the Year 2025 at ILC Power Brand Awards  Network 7 Media Group Announces the 14th Annual India Leadership Conclave & Power Brand Awards 2025 With The Theme: “India@3: Power, Purpose & People”

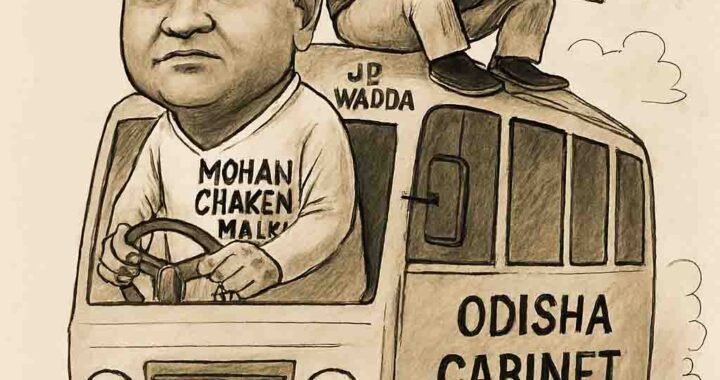

Network 7 Media Group Announces the 14th Annual India Leadership Conclave & Power Brand Awards 2025 With The Theme: “India@3: Power, Purpose & People”  Cabinet Reshuffle Looms as Odisha CM Majhi Meets BJP Top Brass in Delhi

Cabinet Reshuffle Looms as Odisha CM Majhi Meets BJP Top Brass in Delhi  Berhampur’s Fault Lines: Has Dr. Ramesh Chandra Chyau Patnaik Been Cast Out of BJD’s Inner Circle?

Berhampur’s Fault Lines: Has Dr. Ramesh Chandra Chyau Patnaik Been Cast Out of BJD’s Inner Circle?